Explain Different Continuation and Reversal Patterns

The continuation or reversal candlestick pattern should be located on this strong supply demand zones. Opens below the low of the 1st day.

:max_bytes(150000):strip_icc()/dotdash_Final_Continuation_Patterns_An_Introduction_Jul_2020-01-3545a8ca01b94663a186308a5d7a5c5f.jpg)

Continuation Patterns An Introduction

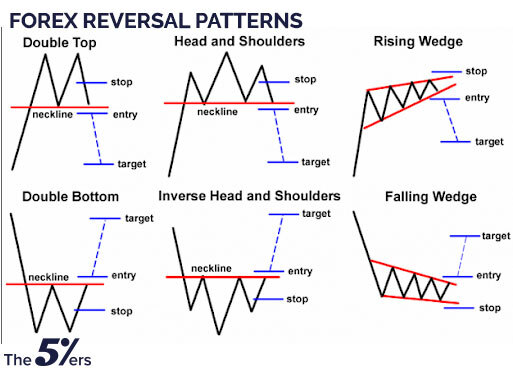

When a price pattern signals a change in trend direction it is known as a reversal pattern.

. If price breaks out in the opposite direction of the prior trend the pattern is defined as reversal. Using chart patterns for swing trading is also pretty important. Continuation patterns continue the existing trend eg.

Measured Move - Bearish. Continuation and reversal patterns. It tells the trader that the trade is worth consideration.

Reversal chart patterns can also be trend continuation patternsthe context is what matters. Overall trend should be down 2. If price breaks out in the same direction of the prior trend the pattern is defined as continuation.

Some common reversal chart patterns are the inverse head and shoulders ascending triangle and double bottom. Different testing methodologies to evaluate the robustness of the results controlling for risk and non-risk factors and assess the validity of alternative hypotheses that have been put forward to explain continuation and reversal patterns in returns. There are two important types of patterns.

The rising wedge forex pattern is linked with both continuation and reversal patterns as mentioned above. Spinning top Identifying the Strongest Candlestick Reversal Patterns. In other hand identifying that the bulls or bears have lost control and there may be a change of trend is what reversal patterns do.

Dark Cloud Cover Continuation Candlestick Patterns. For example if the stock is up its reversal pattern will be a down trend. You can use chart patterns for day trading.

Chapter 3 The Indecision and Continuation Patterns. Every reversal chart pattern has 3 components to it. 2nd day closes within but above the midpoint of the 1st days candle.

Bearish reversal patterns appear at the end of an uptrend and mean that the price will likely turn down. Just a quick refresher there are 2 main types of chart patterns continuation chart patterns and reversal chart patterns. Continuation patterns identify opportunities for you to continue with that trend weather is going up or down.

1 trending vs retracement move 2 lower highs and higher lows 3 time factor. Technical analysts have long used price patterns to examine current movements and forecast future market movements. Continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play.

Note that we have classified these chart patterns by whether they are typically reversal or continuation patterns but many can indicate either a reversal or a continuation depending on the circumstances. Compare different types of gaps and their significance Contrast various continuation patterns and reversal patterns Draw examples of various top formations and bottom formations Apply. A continuation pattern occurs when the trend continues in its existing direction following a brief pause.

Measured Move - Bullish. The continuation patterns are channels flags and pennants and trendlines. Here is the major reversal candlestick pattern that we should use on our trading analysis before we make some decision buy or sell.

If a stock is down its reversal pattern will be an uptrend. The reversal patterns are island reversal moving average crossover and head and shoulder formation. After we can identify this supply demand zone the second way is reading candlestick pattern.

These patterns occur in the middle of. Continue reading and familiarize yourself with the candlestick patterns that well be talking about today. Downtrend price pattern downtrend or uptrend price pattern uptrend.

Continuation Correctional StructurePattern Bullish Bearish Flag Bullish Bearish Pennant Parallel Channel Reversal Correctional StructurePattern Ascending Descending Channel Rising Falling Wedge Double Top Bottom Head Shoulder PatternInverse H and S M and W style pattern Reversal Impulse Price Action I will forward all the price action structurespatterns. A reversal pattern is a change in the direction of the stock price. Wedge patterns are composed of converging trendline support and trendline resistance.

A technical analysis pattern that suggests a trend is exhibiting a temporary diversion in behavior and will eventually continue on. A continuation pattern indicates an ongoing price trend in the same direction. A continuation pattern tells you the trend will continue once the pattern is complete.

Next lets dive straight in and study the different types of price patterns. On our previous two chapters weve discussed 1 bullish reversal candlestick pattern and 2 the bearish reversal candlestick pattern. A reversal pattern signals that the trend is about to reverse after the pattern has completed itself.

Candlestick Chart Patterns. The Psychology Behind The Move In a downtrend or during a pullback within an uptrend the stock or etf gaps down buyers step in and then rallies. The reliability of this pattern is very high but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

The example below shows the formation of a rising wedge on a forex pair depicting a. Explain the six basic tenets of Dow Theory. Bearish Candlesticks reversal patterns are.

The candles body is small.

What Are All The Reversal And Continuation Patterns Do You Know In Chart Reading Technical Analysis Stock Market Quora

Chart Patterns Vs Candlesticks Patterns The 5 Ers Forex Blog

This Is About Type Of Reversal Pattern Continuation Pattern And Bilateral Pattern In Forex Tradi Trading Charts Stock Chart Patterns Technical Analysis Charts

No comments for "Explain Different Continuation and Reversal Patterns"

Post a Comment